Already the worldwide healthcare wearables market accounts for US$6.8 billion of the current US$25 billion wearables market. ABI forecasted late August that wearable healthcare, including healthcare devices, sports, fitness, and wellness trackers will continue to dominate the wearables market and will exceed revenues of US$10 billion in 2022. Disposable sensors will become an important segment within wearable healthcare.

“Disposables are already a feature of healthcare provision around the globe and medical sensors will have to fit into that world,” explains Jonathan Collins, Research Director at ABI Research. “Efforts already underway promise considerable progress over the next few years. Their potential to extend and simplify the benefits of remote patient monitoring will help drive the adoption of both.”

A host of companies is investing in developing disposable sensors, but are taking varied approaches regarding sensor format and supporting technologies. These companies range from established players including Philips Healthcare and Medtronic to well-backed ventures like Qualcomm Life and smaller start-ups like GenTag and Proteus Digital Health. In addition, a range of wireless protocols are under consideration for adoption in disposable smart health sensors including Bluetooth, NFC and Proprietary offerings.

“What these and many other companies share is an understanding that healthcare workflows and reimbursement payments are already steeped in the broad use of disposable devices. Between now and 2022 will be a key time for these vendors and others to address technical and ecosystem complexity around disposable sensor connectivity. It will also be the primary time for vendors to gain a foothold in the emerging market,” says Collins.

“As an ultimate form factor of wearables, flexible body-worn sensors are quite an innovation for wearable adoption in healthcare, fitness, and human-machine interface,” says Marina Lu, Senior Analyst at ABI Research. “These sensors can be integrated into a small patch and attached to human skin surface to track vital signs and other biometrics continuously and wirelessly. Some of the implementation examples include electronic tattoos and skin sweat sensors.”

Replacing costly doctor visits and painful lab-based blood tests, non-invasive sweat sensors can measure a set of key biometrics from a single bead of sweat. A few companies are working to capture the sweat sensor market, such as Eccrine System, GraphWear Technologies and Kenzen. These sensors require flexible components and startup Royole is leading the way. Royole’s plan for mass production of flexible displays and sensors will accelerate the technology adoption for wearables and facilitate more aesthetically-pleasing wearable designs, smaller form factors, and more immersive experiences.

“Health sensors are becoming increasingly commoditized, as they allow continuously physical monitoring with reduced manual intervention and at low cost,” concludes Lu. “While the miniaturized health sensors enable consumers to monitor health conditions by themselves and be aware of their own health care, they also extend to the enterprise market by delivering superior analytics for clinical and medical research. Once privacy and security concerns are addressed and standardization in health communication protocols are put into place, the next-gen of wearable healthcare will be ushered in.”

“Disposables are already a feature of healthcare provision around the globe and medical sensors will have to fit into that world,” explains Jonathan Collins, Research Director at ABI Research. “Efforts already underway promise considerable progress over the next few years. Their potential to extend and simplify the benefits of remote patient monitoring will help drive the adoption of both.”

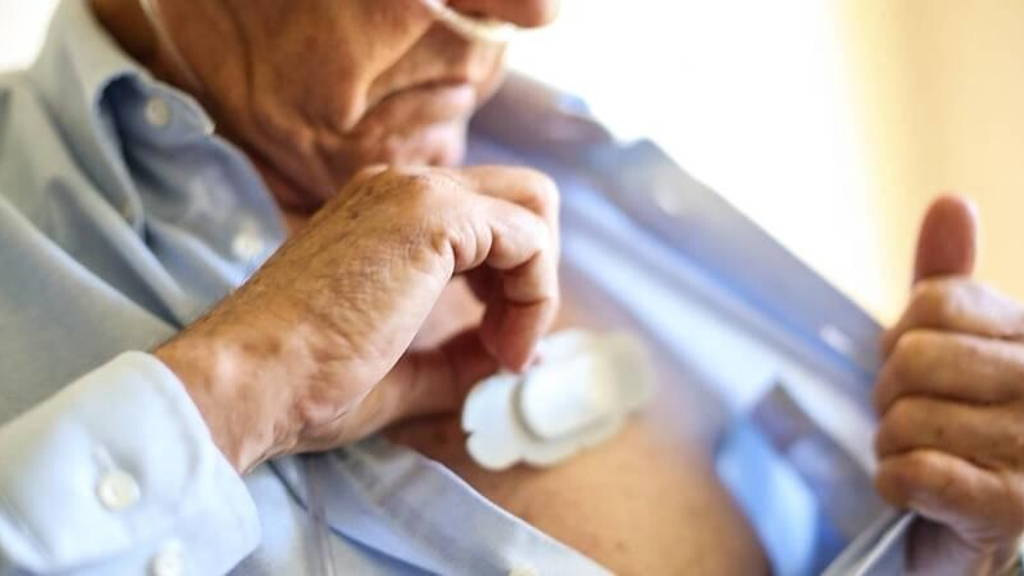

Disposable sensors commmonplace in glucose monitoring

Disposable sensors, without embedded wireless transmitters are already commonplace in remote patient continuous glucose monitoring applications from Dexcom, Medtronic and others, but their potential reaches far beyond. Disposable connected sensors can support applications including medication tracking, temperature, heart rate and pulse oximetry as well as activity/movement/post-surgery orthopedics monitoring that address a far larger user-base.A host of companies is investing in developing disposable sensors, but are taking varied approaches regarding sensor format and supporting technologies. These companies range from established players including Philips Healthcare and Medtronic to well-backed ventures like Qualcomm Life and smaller start-ups like GenTag and Proteus Digital Health. In addition, a range of wireless protocols are under consideration for adoption in disposable smart health sensors including Bluetooth, NFC and Proprietary offerings.

“What these and many other companies share is an understanding that healthcare workflows and reimbursement payments are already steeped in the broad use of disposable devices. Between now and 2022 will be a key time for these vendors and others to address technical and ecosystem complexity around disposable sensor connectivity. It will also be the primary time for vendors to gain a foothold in the emerging market,” says Collins.

Healthcare wearables move beyond smartwatches

Healthcare wearables that monitor health conditions, physical performance, and brain activity will move beyond smartwatches and fitness trackers; they will shrink in size and change in form factor type. Unlike today’s bulky health related devices, ultra-thin and ultra-soft sensors with software analytics make next-generation wearables smarter and more useful, ABI believes.“As an ultimate form factor of wearables, flexible body-worn sensors are quite an innovation for wearable adoption in healthcare, fitness, and human-machine interface,” says Marina Lu, Senior Analyst at ABI Research. “These sensors can be integrated into a small patch and attached to human skin surface to track vital signs and other biometrics continuously and wirelessly. Some of the implementation examples include electronic tattoos and skin sweat sensors.”

Replacing costly doctor visits and painful lab-based blood tests, non-invasive sweat sensors can measure a set of key biometrics from a single bead of sweat. A few companies are working to capture the sweat sensor market, such as Eccrine System, GraphWear Technologies and Kenzen. These sensors require flexible components and startup Royole is leading the way. Royole’s plan for mass production of flexible displays and sensors will accelerate the technology adoption for wearables and facilitate more aesthetically-pleasing wearable designs, smaller form factors, and more immersive experiences.

“Health sensors are becoming increasingly commoditized, as they allow continuously physical monitoring with reduced manual intervention and at low cost,” concludes Lu. “While the miniaturized health sensors enable consumers to monitor health conditions by themselves and be aware of their own health care, they also extend to the enterprise market by delivering superior analytics for clinical and medical research. Once privacy and security concerns are addressed and standardization in health communication protocols are put into place, the next-gen of wearable healthcare will be ushered in.”